- 50 pips a day forex strategy manual#

- 50 pips a day forex strategy code#

- 50 pips a day forex strategy professional#

Many professional traders suggest that this is a good day trading strategy for newcomers the reason is that you do not require to study difficult indicators or cost designs.

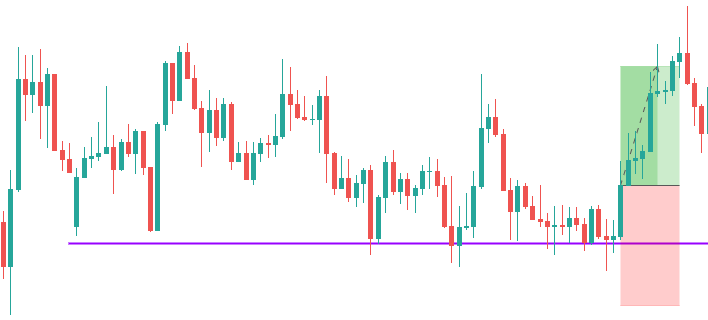

Introduction Of The 50 pips A Day Trading Strategyĥ0 pips a day is a quite comfortable day trading strategy, although keep in your mind that various times, the best day trading strategies that effort are really uncomplicated in a pattern which may form them totally powerful. GMT then close the open position/cancel the pending orders.In this article, we will discuss the 50 pips a day trading strategy. If you have an open position (or a pending order) still open at 3 p.m.The target profit should be set to 50 pips – if this is reached then close your position.A stop-loss order should be placed 5 pips above the high/low of the 7 a.m.– This is where the multi time frame comes in I assume GMT candlestick closes, place two opposite pending orders: a buy stop order 2 pips above the high and and sell stop order 2 pips below the low of the 7 am GMT candlestick. When price activates one of the pending orders, you cancel the other pending order that has not been activated.

50 pips a day forex strategy code#

How would we write code with more precise rules, for example: Is it very difficult to write that type of code? I am actually interested in using multi time frame in the strategy as the ”one order cancels the other” type of order is something I want to experiment with. But if you set you own clear rules it shouldn’t be impossible to write a code right? I mean even if I want to trade the strategy manually I assume I should back test it first so I get an idea if it’s even worth pursuing this trading strategy.

50 pips a day forex strategy manual#

I guess these types of strategies fit manual trading better. Very helpful!Īs you can see I am a beginner and when you describe it like that it makes sense that it is hard to automate trading for a strategy that don’t have very clear set rules. Sometimes these simple ‘make 50 pips in a day’ type strategies can be very poorly described and so leave the coder somewhat guessing! The image shown seems to indicate that you hold for 24 hours. If midnight then you will be paying (or possibly receiving) overnight fees at 2200 and then closing the trade two hours later when spread is at its largest. End of the US session, End of the UK session. They also say ‘If you trade has a floating profit or a floating loss, wait until the end of the day and exit your trade, regardless of if you have a profit or loss’ but do not clarify what ‘end of the day’ actually means. GMT candlestick is too short and that placing the stop loss will be too close to the entry price, then increase your stop loss distance to anywhere from 15-20 pips’ but do not specify what ‘too short’ actually is. Due to the fast time frame needed available data in PRT for back testing will be very limited. 1 hour to make the decisions and a fast time frame like maybe 1 second to cancel the other order very quickly. From a quick read of the rules it is clear that to place two pending orders on the market and then cancel one if the other is hit that we would need to use multi time frame in the strategy.

0 kommentar(er)

0 kommentar(er)